IRS Tax Debt: How a $137,967 Was Settled for $864

How to Get the Best IRS Tax Debt Settlement Offer-in-Compromise

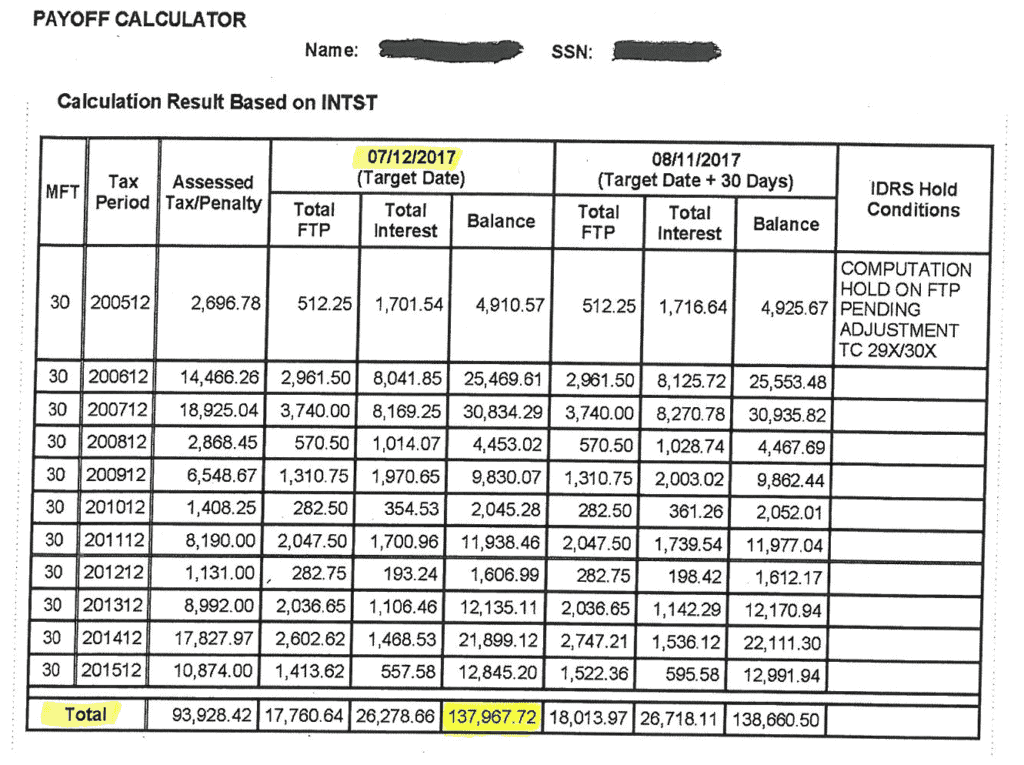

Although the IRS maintains its reputation as the most powerful and feared collection agency in the world, it’s important to remember that all of its powers come from the Internal Revenue Code, or Tax Code. And within the Code, and other rules and regulations that the IRS must follow, American taxpayers are afforded a variety of options when dealing with back taxes. In January 2016, “Bob” (real name withheld for privacy) called our office in a panic due to over $100,000 in IRS back taxes that he was struggling to deal with. He owed taxes for 11 straight years, and to make matters worse, the IRS had already filed a tax lien and was levying his wages and bank account. You can see Bob’s IRS tax liability below:

At Landmark Tax Group, we always begin every tax relief case with the same important question:

“What is the most favorable resolution that the law will allow based on the specific facts and circumstances of the case?”

While simultaneously stopping the IRS levies and placing a hold on enforcement action by the IRS Agent, we considered various solutions to Bob’ case, such as a:

- Payment Plan

- Currently-Not-Collectible (CNC)/ Financial Hardship

- Penalty Abatement

- Offer-in-Compromise

Based on the facts and circumstances of Bob’s case, we ultimately decided to pursue an Offer-in-Compromise (OIC). An OIC, commonly referred to as a “tax settlement”, is an agreement between the IRS and a taxpayer that settles a tax debt for less than the amount owed. An OIC allows you to have some of your tax debt forgiven, leaving you only to pay the agreed upon amount. While this may seem like a quick and easy fix, it’s important to note that an Offer-in-Compromise has stringent requirements, and a decision to pursuean OIC is one that should only be made with the help of a licensed tax relief professional. Once a taxpayer files for an OIC, the IRS will take the following figures into consideration (among others):

- Current income

- Current and future earning potential

- Total monthly/yearly expenses

- Equity in assets

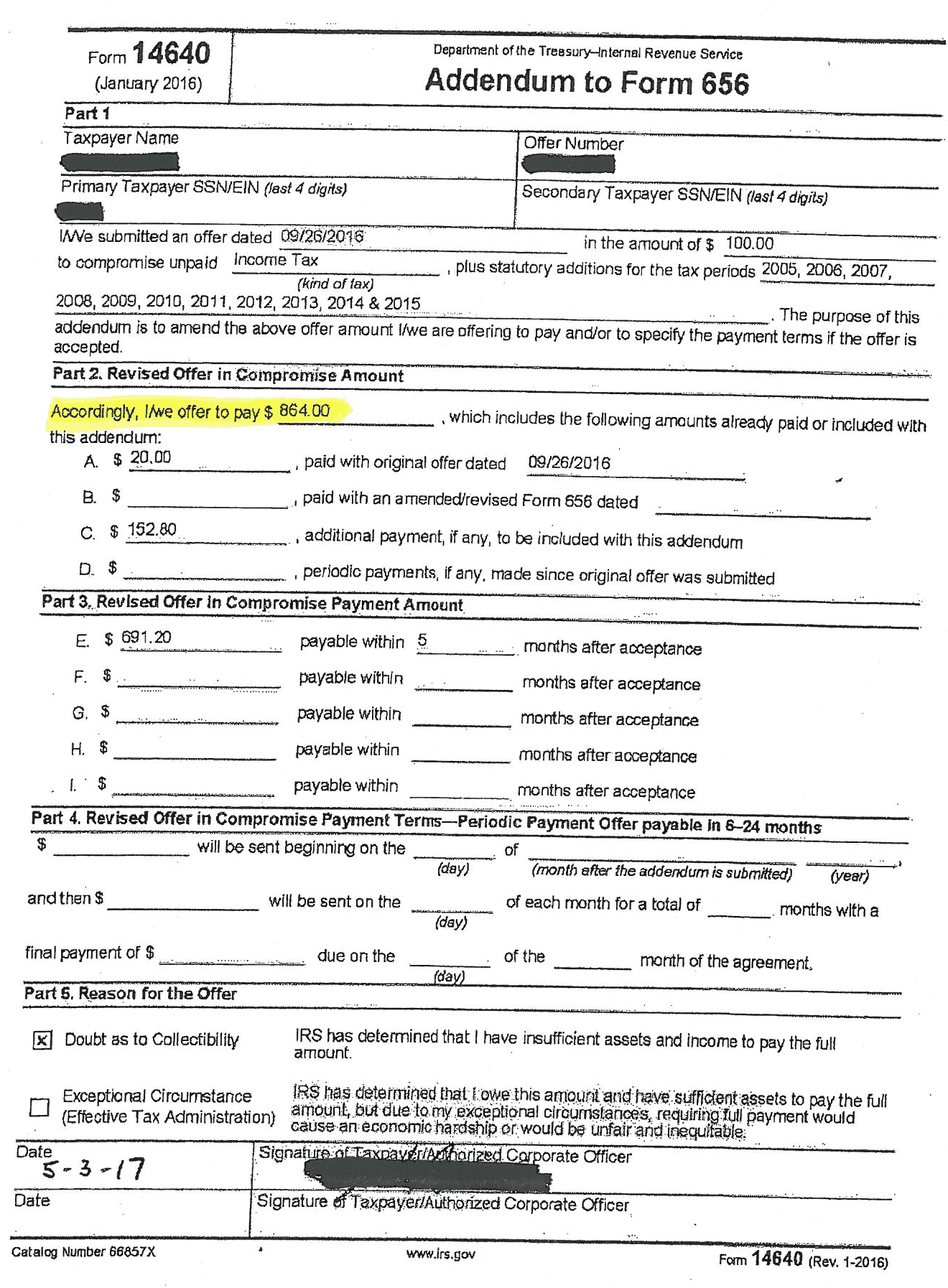

In Bob’s case, we prepared the required OIC documents and submitted the completed package to the IRS with an Offer amount of $100 – this figure was determined in accordance with IRS calculation rules and procedures. After waiting several months, Bob’s OIC case was assigned to the Offer-in-Compromise Unit in New York where we thoroughly reviewed his financial information with the assigned IRS Agent. As is typical of OIC cases, Bob’s income, expenses, assets and much more were discussed, scrutinized, and debated over many more months. Following an agreement by all parties with respect to Bob’s collection potential, we then submitted the following form which increased the Offer figure to $864.00:

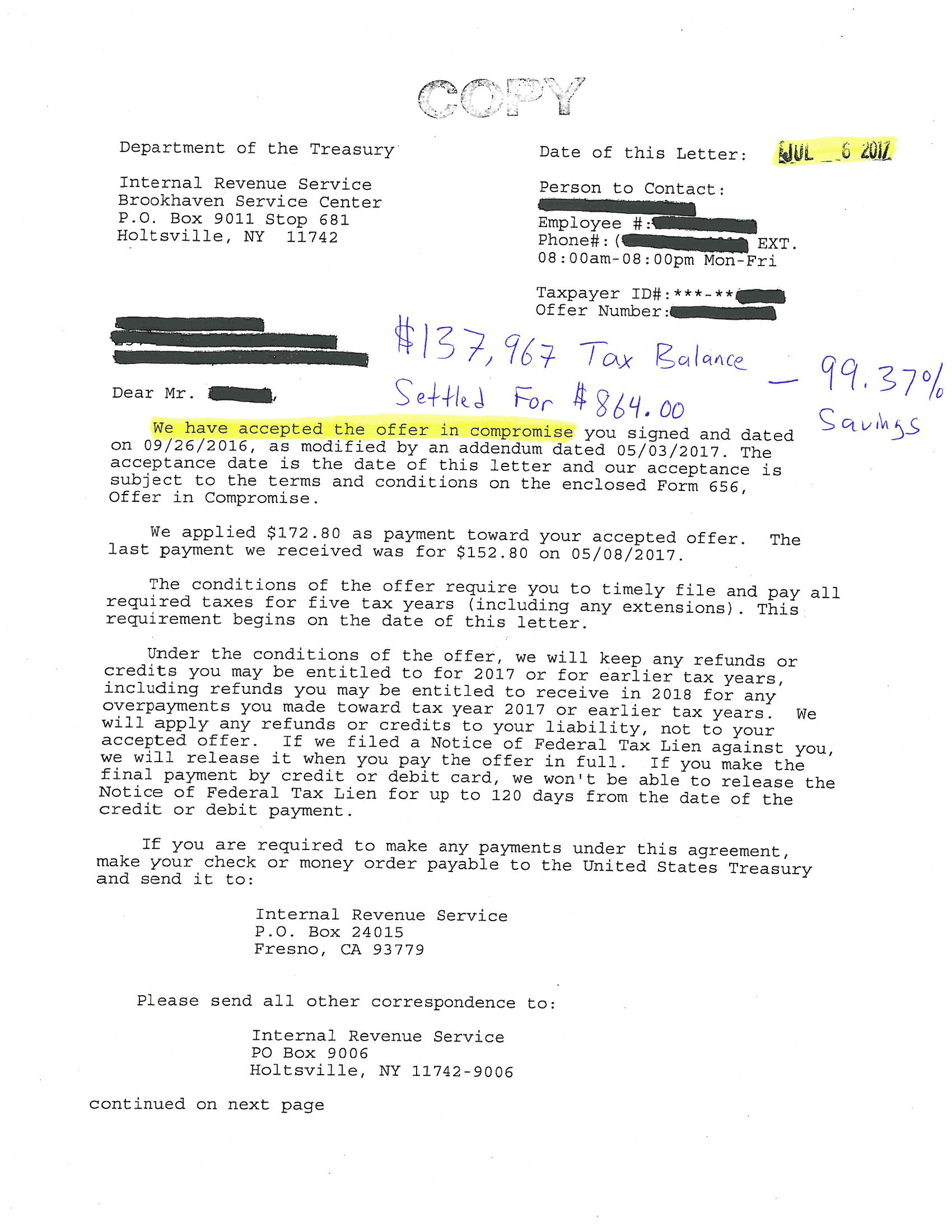

Over two months later, we finally received word that Bob’s offer of $864 was officially accepted by the IRS as full payment of his $137,967 tax liability – a savings of over 99.37%

The Tax Code states: “We will accept an Offer in Compromise when it is unlikely that we can collect the full amount owed and the amount you offer reasonably reflects the collection potential…” (Internal Revenue Code §7122). While an OIC may not be appropriate for every taxpayer who has back taxes, the IRS did recently expand its Offer-in-Compromise program under its Fresh Start Initiative to include more flexible terms, allowing more taxpayers to qualify now than in the past. As you can see from Bob’s case, if you do qualify, your IRS tax debt may be settled for a fraction of what you owe. Contact us now to see if an IRS Tax Settlement Offer-in-Compromise is right for you – consultations are always confidential.

Get our Free Special Report: 7 Secrets the IRS Doesn’t Want You to Know!

Landmark Tax Group is a professional tax resolution firm that specializes exclusively in IRS and State back tax issues. Not only are we licensed Tax Relief Specialists, we are also former Senior IRS Agents who now serve the best interests of taxpayers like you – all we do is handle IRS and State Tax Relief matters, all day, every day.

If you owe back taxes and would like Landmark Tax Group to review your tax case, please contact us now for a confidential consultation with one of our former IRS Agents.