IRSvideos.com Affiliate Partner Agreement Terms and Conditions There is no cost associated with becoming an Affiliate Partner and all you ...

In a recent post, we reminded you that your IRS tax debt expires — and now, thanks to IRSvideos.com, you ...

One of the most frustrating things about back taxes is that the bill you owe the IRS is almost never ...

Until now, taxpayers have had three options for resolving their IRS back taxes: 1. You can hire a tax lawyer … ...

Yes, it’s true: Just like the cream cheese and mystery sauce in the back of your fridge, your IRS back ...

Ten years and one month ago, I was an IRS Agent sitting in a federal office. I had eight years ...

Landmark Tax Group won a Jim Moran Institute for Global Entrepreneurship Seminole 100 award! The Seminole 100 award celebrate the ...

April is Stress Awareness Month, and although the experts won’t admit it, there’s only one thing they could have had ...

Welcome to April, the busiest month of my year! The tax deadline is on Monday, April 18 2022, which means ...

In football, a single bad play can cost you the game — and it’s the same with your fight against ...

On Monday, April 18, our 2021 IRS tax returns are due. Yikes! If you have a back tax issue right ...

Landmark Tax Group was recognized as one of the fastest-growing companies owned or led by Florida University alumni during the ...

A few months ago, our team opened one of the most heartwarming emails we’ve ever received. It came from a ...

Imagine you’re getting dressed one morning when you notice a dark spot on your skin that looks like it could ...

Goal-setting isn’t just an exercise for the new year. My team and I do it all the time with our ...

The IRS has a lot of power to throw around, and one of the scariest things it can do is ...

The holidays are a hectic time for all of us, but one thing you can’t afford to forget right now ...

As I write this, I’m looking across my desk at a big pile of books. I’ve been working my way ...

Thanksgiving is almost upon us, and here at Landmark, we’re feeling particularly thankful for the other businesses that support our ...

When you’re facing a mountain of back taxes and threatening letters from the IRS, the last thing you want to ...

Thanksgiving is almost here, and as part of our big holiday lunch, my family goes around the table to talk ...

According to Google, this year’s hot Halloween costumes include Wonder Woman, Cruella DeVil, and Forky from “Toy Story 4.” Your ...

If you own a home, then you know having such a huge asset means everything. It shelters you from the ...

If you have a tax problem, there are only three kinds of people allowed to help you negotiate with the ...

If there’s one thing football season reminds us each year, it’s that a coach can make or break their team’s ...

If you owe back taxes to the IRS, you might feel scared, overwhelmed, and anxious every time you think about ...

We have good news for those facing long-term back taxes: The IRS has a set time period to collect unpaid ...

Is the IRS ‘Dogging’ You? – July and August are part of the dog days of summer, an unofficial period ...

Penalties and interest imposed by the IRS can double or triple your federal tax liability. However, there are two primary ...

The month of July is closely associated with Independence Day. It’s a celebration of freedom and, of course, independence. For ...

We talk a lot about what to do when you owe the IRS or if you’re dealing with IRS-related issues, ...

You’ve seen the ads: “We solve your tax problems for pennies on the dollar!” “We are the only tax resolution ...

Dealing with the IRS can be a nerve-racking and painstaking process for taxpayers. The Tax Code is so complicated that ...

Landmark Tax Group is a Seminole100! This year during the 4th Annual Seminole 100 Ceremony that happened in February 2021 ...

We are honored to share that “People love Landmark Tax Group on Yelp”! In 2020, we earned a 4.93-star rating ...

The IRS isn’t always the bad guy and often gets a bad reputation. Some of it is deserved; they can ...

If you are planning on late filing, don’t “fall to the Dark Side with the IRS. This month’s article is ...

Learn what IRS Notices you may receive if you fail to pay your taxes when you file your return. This ...

By the time you read this, the tax deadline — which is Thursday, April 15 — maybe just a few ...

It’s important to use the correct filing status when filing your income tax return because it can impact the tax ...

These days there are so many filing options for taxpayers to get their tax returns prepared. With so many options ...

Another tax season is upon us. For some people, filing their taxes is a huge relief. For others, it’s a ...

Audits are on the rise. Although there is no guaranteed way to prevent an audit, following these six tips will ...

Gain back control of your IRS matters. Many people are guilty of procrastinating at one time or another but procrastinating ...

Owe $ 10k, we can help! If you’ve been following this newsletter, you know we work with many taxpayers who ...

Are You Ready for a Fresh Start? After a tumultuous 2020, many people are looking to 2021 with optimism. As ...

If you owe back taxes, a 2015 law gave the IRS the power to revoke your passport. They can certify ...

When the IRS knocks, we respond. Consequently, at Landmark Tax Group, we work tirelessly to achieve the results our clients ...

Anytime you deal with the IRS or any tax issues, ensure you get the most sound and up-to-date tax advice. ...

If there is one thing we can all agree on, it’s that it’s been a strange year. However, despite the ...

A success story! A husband and wife were in IRS collections for several years before they learned about Landmark Tax ...

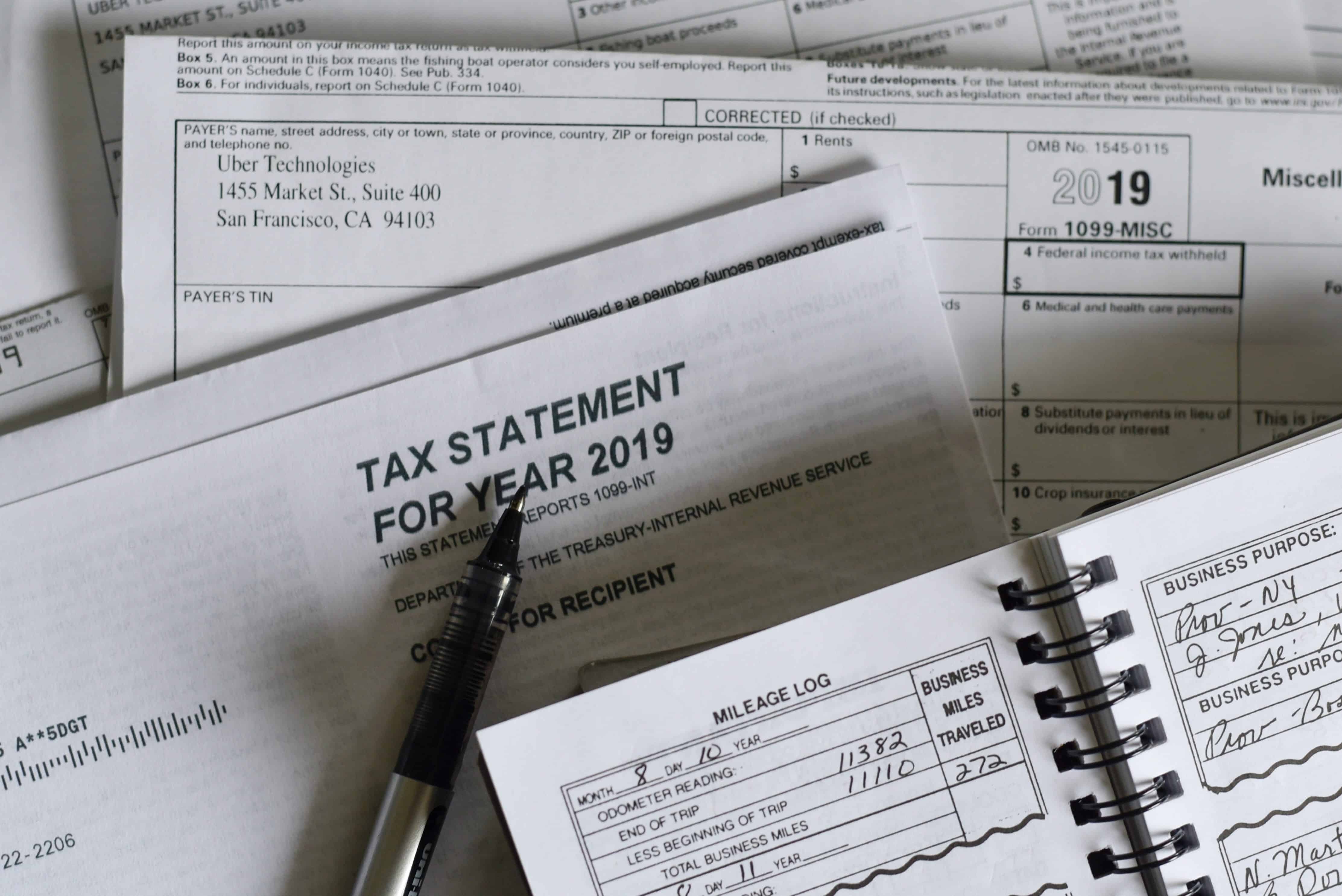

How one man eliminated $91,756 off his tax debt balance. John lost 40% of his income during the COVID-19 pandemic. ...

Per the Tax Code, a taxpayer can request the removal (abatement) of IRS penalties under two provisions: the First Time ...

Don’t Let the IRS Put the Haunt on You: The Not-So-Scary Truth About Tax Relief Imagine getting a letter from ...

Not only do we at Landmark Tax Group help individual taxpayers across the U.S. resolve their back taxes to the ...

Here are five serious mistakes for taxpayers to avoid when it comes to back tax: Mistake No. 1: Delaying to ...

You may hear the term “IRS tax relief,” but do you know what it means? The truth is that IRS ...

Recently, Landmark has hit an enormous milestone for our company: reaching $100,000,000 in resolved back taxes! I’m excited about this ...

While the IRS extended the filing deadline until July 15th, you still may not have enough money to pay in ...

The Power of an Amazing Team We know how hard it is to endure the stress and anxiety experienced as ...

The IRS is reopening July 15, which means 2019 tax returns and payments are due. The IRS will resume enforcement, ...

As companies are recovering from COVID-19, some are utilizing the Paycheck Protection Program (PPP). If you own a qualifying small ...

Though the IRS is usually an additional source of stress, they’re working on ways to ensure they’re a source of ...

At Landmark Tax Group, we’re always excited to highlight our clients’ IRS success stories! This one was especially stressful for ...

As I write this, many of us are adjusting to a new “normal”: working from home, managing education for our ...

You’ve heard the commercials proclaiming, “We solve your tax problems for pennies on the dollar!” But as the saying goes, ...

Right now, there is a lot on everyone’s mind, like managing your children’s online education, making grocery runs, and monitoring ...

Life happens, so you need to be prepared for how major changes will affect both your well-being and your bottom ...

Is The IRS Piling On Debt? We might be in spring, but when the IRS knocks on your door, it ...

Another tax season has come and gone. But for those who still owe money, it can feel like finishing a ...

DON’T MISS OUT ON THIS MAJOR OPPORTUNITY TO POSSIBLY SETTLE WITH THE IRS! CONTACT US NOW: – PHONE: 949-260-4770 – ...

Learn to Play the Game With the IRS As an entrepreneur, the tax system can be like playing multi-level chess. ...

What the IRS 2020 Budget Tells Us Whenever we see news on the IRS and the struggles they face internally, ...

The Collection process of the IRS As the tax season is in full swing, I’m reminded of some interesting moments ...

Is the IRS After You? If the IRS sends you a subpoena or knocks on your door this spring, you ...

Have No Fear, IRS Payment Plans Are Here! With tax season in full swing, it’s a stressful time of year. ...

Minimize What You Owe by Taking These Tips to Heart While many people are focused on their loved ones during ...

And How It Helps Me Help You Today Many of my clients aren’t fans of the IRS, as they are ...

We Couldn’t Be Happier For This Client Sometimes we like to highlight case results, and we couldn’t be happier for ...

What You Need to Know About the IRS Any interaction with the IRS can leave you with a pit in ...

Essential Questions for a Tax Relief Firm When dealing with the IRS in any capacity make sure you’re getting the ...

Your Home Office As entrepreneurs we need to find every way we can to save money and a home office ...

Wintertime and the holidays are hectic for all of us with family gifts, decorations, hosting holiday parties. However, one thing ...

During the holidays, so many different activities will grab your attention: family dinners, Christmas shopping, decorating and more. It’s hard ...

When the IRS comes to collect, it can be an anxiety-inducing experience from start to finish, but it’s important to ...

Our clients go through a lot when working with the IRS, and periodically, we like to showcase the progress they ...

When I was a field agent for the IRS, I never went into the field over the holidays, especially during ...

Handling the IRS can be like being in a bad horror movie: too many jump-scares and losing yourself in the ...

As you know, we like to highlight when our clients find success, and these clients, in particular, stood out to ...

Hey, everyone! Occasionally we like to highlight recently resolved cases, and we couldn’t be happier for this particular client! Coming ...

When life happens and you get a collection notice from the IRS, those butterflies in your stomach could turn into ...

Recently the IRS released a roadmap of the Taxpayer Journey through the IRS. Here’s what it looks like: Click here ...

At Landmark Tax Group, we’re always eager to showcase any client who has reached an appealing settlement with the IRS! ...

Recently a client came to us with four years of overdue IRS tax returns, totaling $130,601 in back taxes, interest ...

Like most of us did when we were growing up, a lot of our kids will now be getting to ...

Landmark Tax Group would like to congratulate its client who reached a 95% settlement with the IRS! As a result of ...

Getting a notice from the IRS can be a shocking ordeal, but there’s no need to worry. Panicking isn’t going ...